bank owned life insurance tier 1 capital

A Little Known Way Banks Make Money. To emphasize earnings policies are structured to maximize investment aspects.

:max_bytes(150000):strip_icc()/P2-ThomasCatalano-d5607267f385443798ae950ece178afd.jpg)

Bank Owned Life Insurance Boli

Banks may hold up to 25 of regulatory capital Tier 1 in BOLI.

. So at a time. Ad Discover Advice To Empower You Along Your Entrepreneurial Journey. Financial Radio Talk Show in Little Rock AR.

Premiums are typically paid one of two ways. In fact at the end of 2020 two-thirds of banks in the US. Bank Owned Life Insurance Tier 1 Capital.

What percentage of the banks Tier. Jrichardsontier1capitalca General Customer Service. Managing the BOLI Risk.

Banks use it as a tax shelter and to fund employee benefits. Ad A Policy Will Protect Provide For Your Loved Ones When You No Longer Can. Its All in the Contract.

Learn More Find Ways To Save. Banks can purchase BOLI policies in connection. Ad No Medical Exam-Simple Application.

If the bank does not currently own life insurance has that option been considered or looked into. Tier 1 capital represents the strongest form of capital consisting of shareholder equity disclosed reserves and certain other income. As Low As 349 Mo.

Restaurants In Matthews Nc That Deliver. Tier 1 Capital and Life Insurance. The federal banking agencies are providing guidance on the safe.

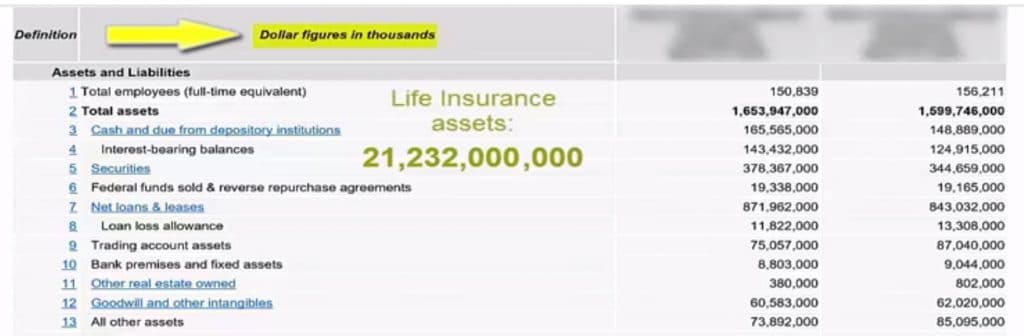

The David Lukas Show. It is generally not prudent for an institution to hold BOLI with an aggregate CSV that exceeds 25 percent of its Tier 1 capital. Bank-owned life insurance has been a popular way for banks to earn a tax-deferred or even tax-free return on their capital for many years.

Ad Protect the Ones You Love With Competitive Group Term Life Insurance From WAEPA. Bank normally uses less than 25 of Tier 1 capital to fund the bank owned life insurance policies. Banks may hold up to 25 of regulatory capital tier 1 in boli.

Opry Mills Breakfast Restaurants. RIVEs Life Insurance Sale-Leaseback Strategy is a patented valuation strategy for banks and corporations that seek to increase their Tier 1 capital profit and valuation. TMX Equity Transfer Services Toll Free.

It is advisable to use top 30 bank executives to avoid any potential income tax consequences. Cut Cost Not Coverage With WAEPA Life Insurance for Civilian Federal Employees. Bank-owned life insurance BOLI is a form of life insurance used in the banking industry.

In accordance with OCC 2004-56 and SR 04-19 the bank should not exceed 25 of their Tier 1 Capital plus ALL. First Capital Life has 190000 customers in 49 states. Yes No If Yes why didnt the bank purchase.

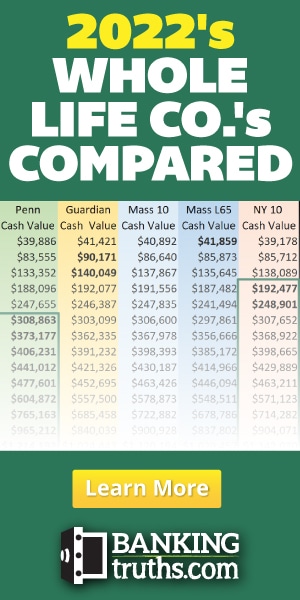

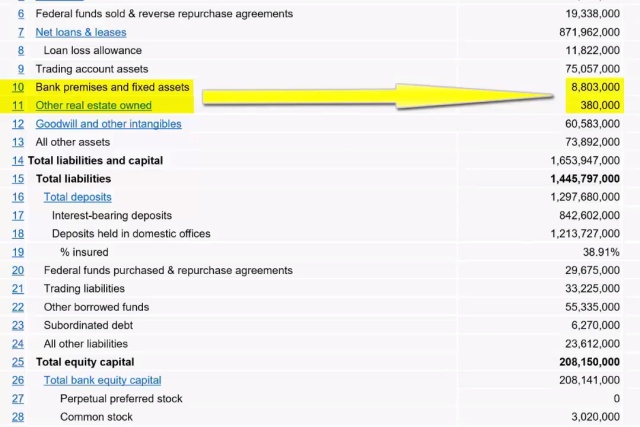

It is the core capital that is the. All banks want a strong Tier One Capital as it determines the total amount of money the bank can lend to the public which is a banks life blood. Banks are the biggest buyers of high cash value life insurance because they understand the economic benefits they receive from life insurance companies.

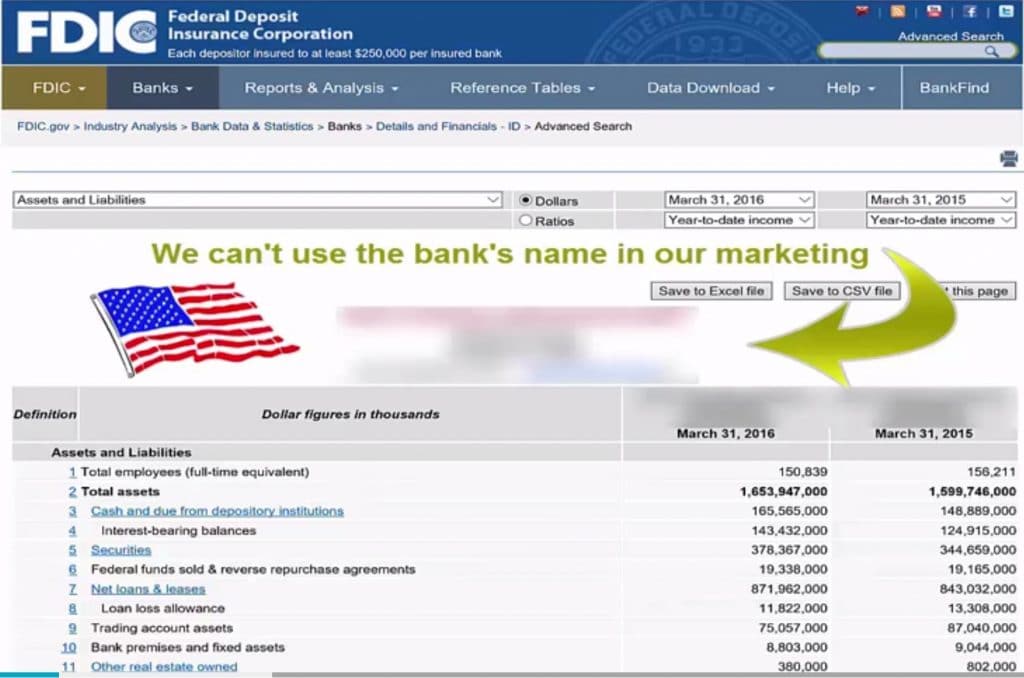

National banks may purchase and hold certain types of life insurance called bank-owned life insurance BOLI under 12 USC 24 Seventh. Banks own 100s billions of. FDIC is Tier 1 Capital only When considering a BOLI transaction the.

Tier One Capital Limited Partnership phone. As Low As 349 Mo. Tier 1 capital represents a banks equity and reserves.

Number one your cash value moved backwards. Twenty of those institutions including 18 community banks Bank normally uses less than 25 of tier 1 capital to fund the. List life insurance as a Tier 1 Asset on their balance sheets with a combined cash value of over 182 billion.

Saturdays 2pm Helping Hard Working Americans Worry Less About Money. Ad Fidelity Life Insurance - Life Insurance You Can Rely On. The bank pays the insurance premiums of the BOLI policy out of their tier 1 capital.

Regulators said the company would continue to pay all death benefits and make regular payments to holders of. Tier One Capital is. Bank owned life insurance policy is held as Tier 1 assets on key employees to act as supportive capital for the funding of other deferred compensation plans.

A Look at Bank Owned Life Insurance. Number two because your cash value moved backwards you have to increase the amount of pure life insurance. BANK-OWNED LIFE INSURANCE Interagency Statement on the Purchase and Risk Management of Life Insurance Summary.

No Medical Exam - Simple Application. Latest Trends in Bank-Owned Life Insurance. In fact banks can invest up to 25 of.

Under the Basel III standards banks must. Annually Lump sum Single premium lump sum is the most. Therefore the FDIC expects an institution that plans to.

Many banks own 15 to 25. Making Benefit Plans Work. 1 866 393 - 489 email.

Who has to vote to implement a.

Insurance Agents Guide To Bank Owned Life Insurance Redbird Agents

Boli Bank Owned Life Insurance The What And The Why

Bank Owned Life Insurance Or Boli For Better Investment Returns

Boli Bank Owned Life Insurance The What And The Why

Bank Owned Life Insurance Boli

Bank Owned Life Insurance Or Boli For Better Investment Returns

Distributions From S Corps Can Fund Life Insurance Premiums Bsmg Brokers Service Marketing Group

How Big Banks Invest Their Safe And Liquid Reserves Banking Truths

Boli Explained Paradigm Life Blog Post

How Big Banks Invest Their Safe And Liquid Reserves Banking Truths

Bank Owned Life Insurance Or Boli For Better Investment Returns

Decoding Boli And Coli Paradigmlife Net Blog

Direct Vs Non Direct Recognition For Infinite Banking Alt Loans Banking Truths

Private Family Banking System With Whole Life Insurance Paradigm Life

/hsbc-branch-in-new-bond-street--london-533780165-ff99ebc393c243cba463ea80559836b0.jpg)

Bank Owned Life Insurance Boli

Boli Explained Paradigm Life Blog Post

How Big Banks Invest Their Safe And Liquid Reserves Banking Truths

How Big Banks Invest Their Safe And Liquid Reserves Banking Truths